2025.09.08 Weekly

A lot of downside risks is in the price, and seeing strong potential of a mispricing and misplaced growth-concerns.

Legit growth-scares?

The market reacted negatively to the weak payrolls number on Friday despite rate cutting expectations getting more aggressive. And when both stocks and yields fall in tandem, that's indicative of a growth-scare.

While it's not an easy market environment to take high conviction views, I do think there is an awful lot in the price and therefore continue to think it's beneficial to think tactically about trading views, as well as growth-scares being misplaced on which I seek to answer by making a detailed account of the recent macro data for this week's note, as well as my trade I'm focused on.

Macro

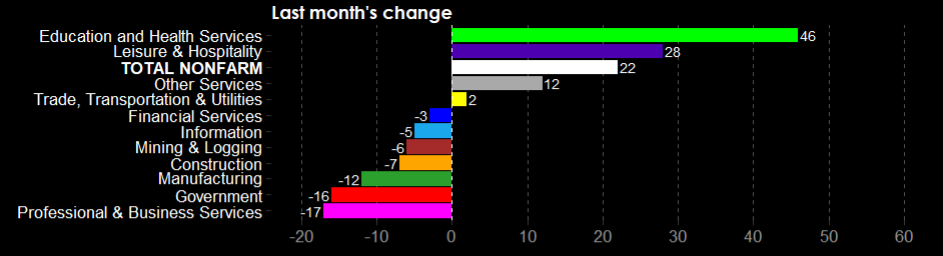

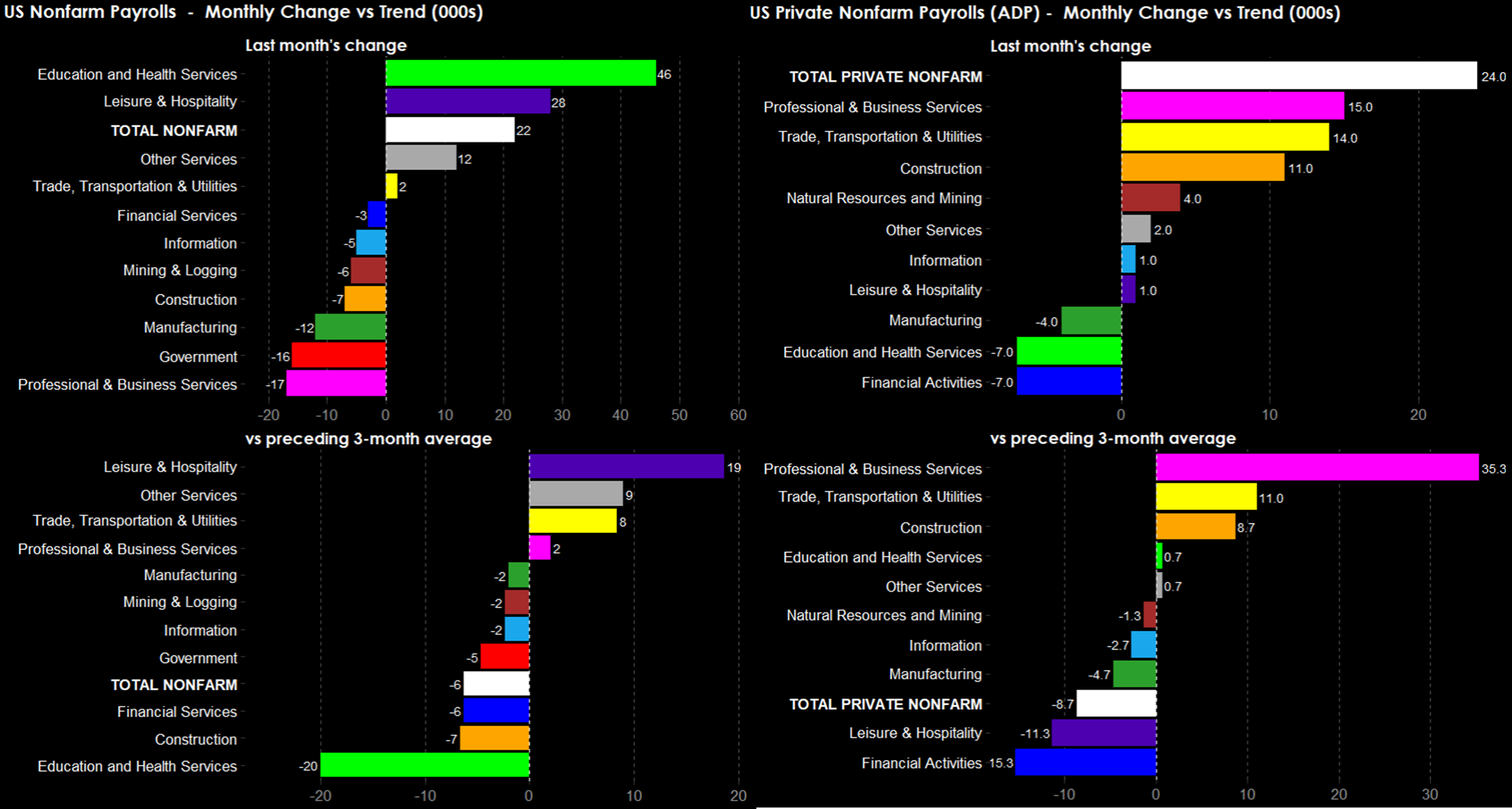

NFP increased +22k in August, far below the median expectation of +75k and at the low end of estimates. Prior 2-months saw a negative net revision of -21k, July revised up +9k while June was revised down -27k. Professional & Business Services (PBS) saw the biggest monthly decline while Education & Health Services (EHS) drove most of the gains.

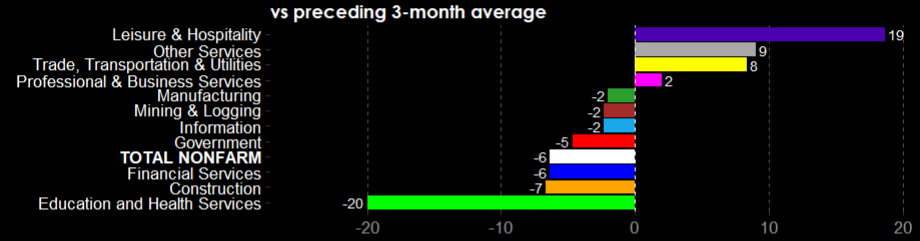

Perhaps the bright spot is that job gains in Leisure & Hospitality (L&H), Trade Transportation & Utilities (TTU) is holding steady while the slowdown in PBS has decelerated versus the prior 3-month pace. EHS also saw a significant slowing vs the prior 3-month pace.

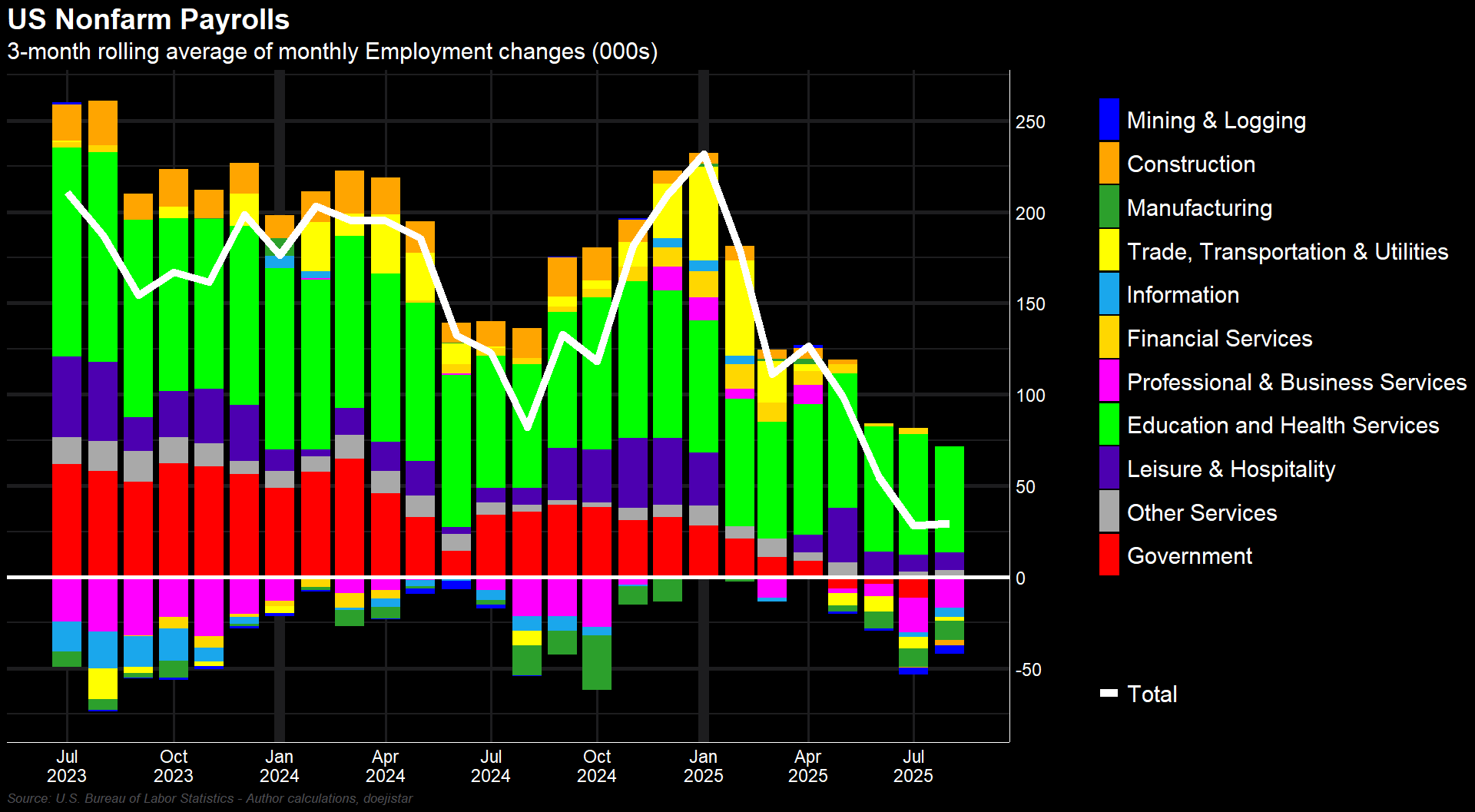

After the big revisions, the 3-month pace of NFP declines has stalled, but its EHS and L&H that is holding up overall job gains.

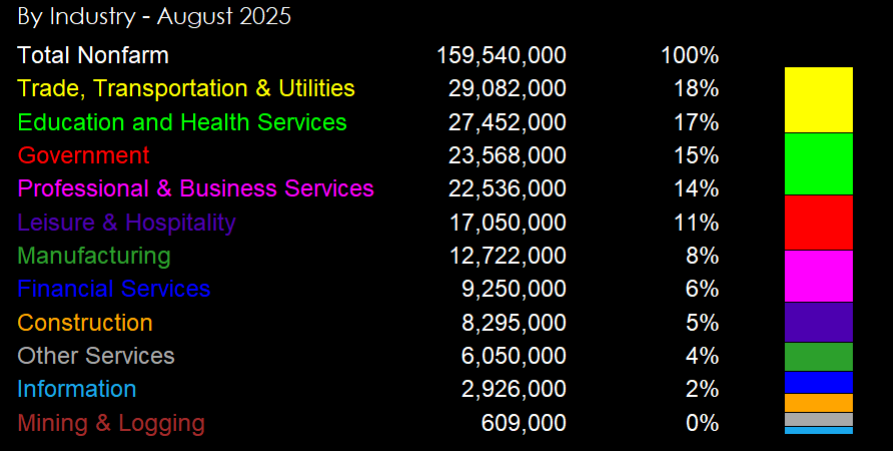

Generally, I like to focus on the top 4 or 5 largest industries when looking at payrolls data which is ranked as follows.

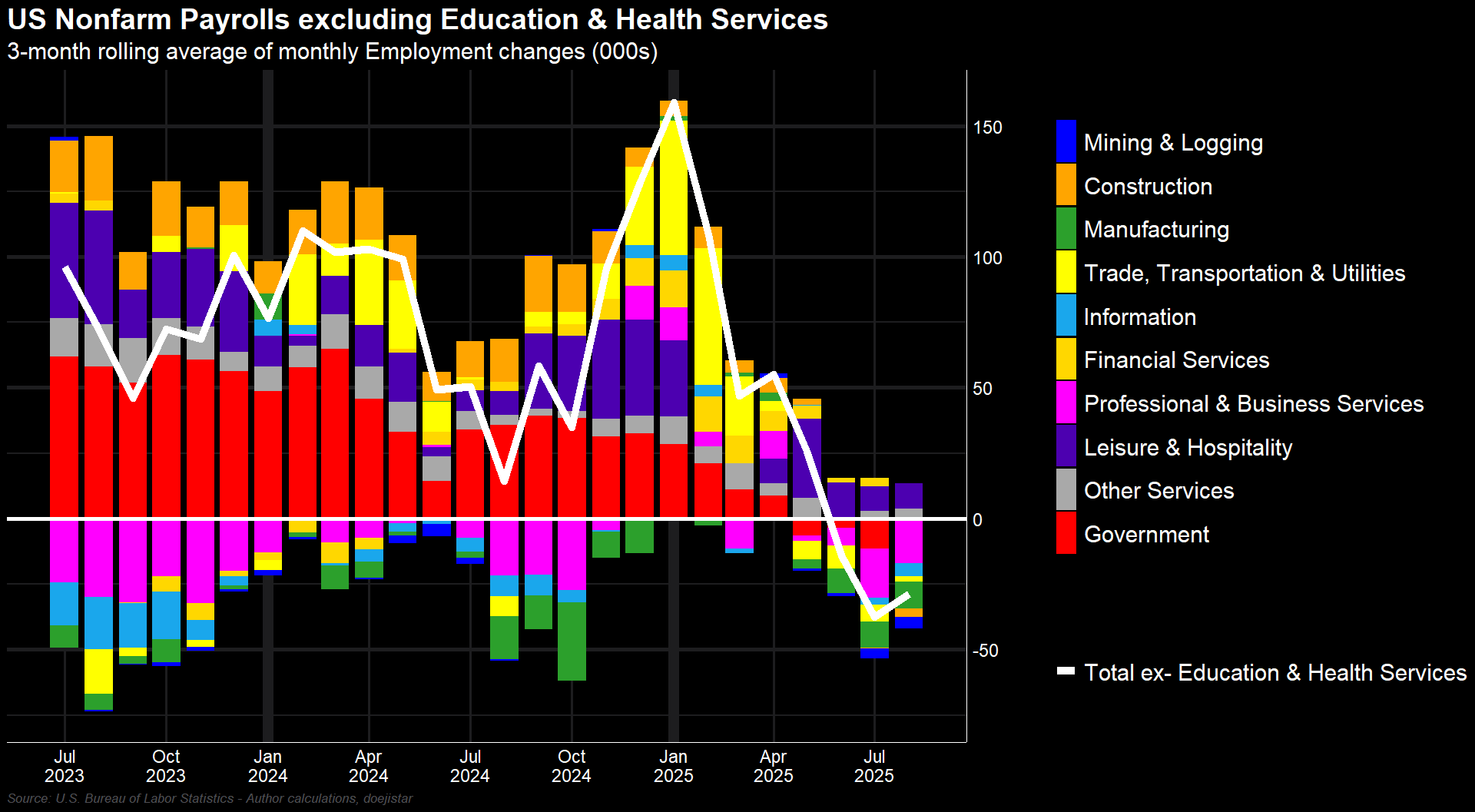

Given EHS has consistently made up for most of the job gains over the last 2-years, excluding those and we see the 3-month trend of job gains turn negative in June, with sizeable job losses in PBS, as well as TTU which is the largest US industry workforce.

That is at odds with the ADP report that is arguably more reliable being derived from their own database of high-frequency payrolls data, while the BLS NFP uses statistical sampling methods. One big discrepancy is PBS and TTU (the 2 largest industries) both showing healthy gains last month and, at an accelerated pace relative to it prior 3-month average. Construction and Mining also had positive changes in ADP employment while the BLS reports negative.

There is clearly a lot of uncertainty and reliability issues around the establishment survey figures given statistical assumptions in the sampling method being unable to reflect structural changes to the labour market that is seeing significantly low labour market churn, impact of AI affecting on entry-level workers seeing that youth unemployment is ticking up, and most of all - accurately estamating the population numbers due to tighter immigration policies. As a result, it is difficult to assess how weak (if at all) the NFP numbers actually are.

Depending on what assumptions were used in the CPS (Current Population Survey), whose inputs are used to measure the size of the labour force and thus the participation and unemployment rates, the uncertainty is around the concept of Breakeven Employment Growth i.e. the level of monthly job gains needed to maintain a constant unemployment rate. Jed Kolko lays out how the breakeven number differs based on 3 currently-plausible assumptions:

- +88k/month based on current census estimates that implies net adult immigration of +545,000 over six months;

- +27k/month if net immigration is Zero (arrivals match departures); and

- -184k/month if net immigration in Negative where 1.9mln would leave in 6months.

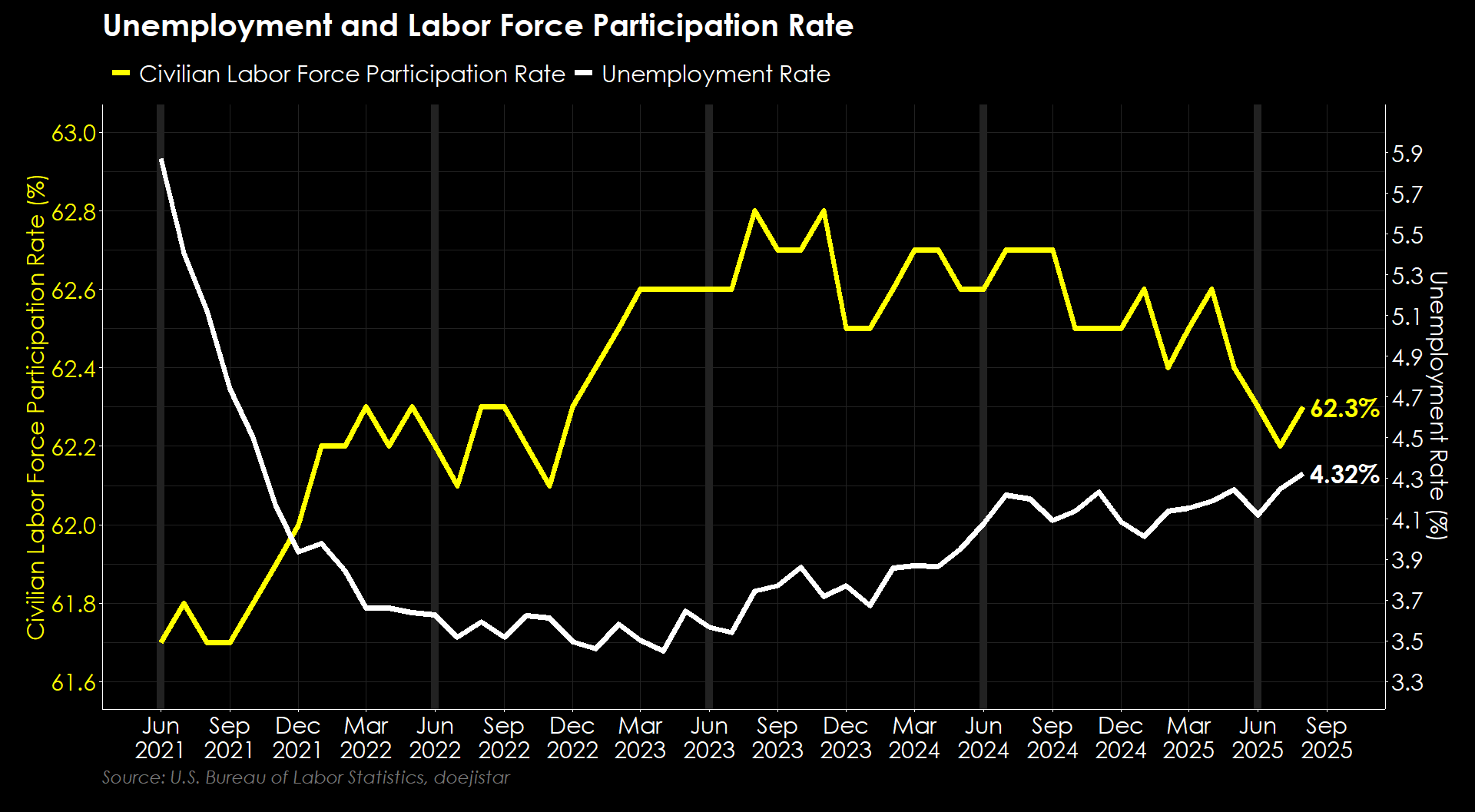

In short, the NFP numbers appear to offer little signal value for the Fed, and will therefore likely give ADP reports more weight, as well as focus on the UE rate which rose to 4.32% to a near 4-year high while the LFP rate has ticker higher last month - suggesting increased slack last month.

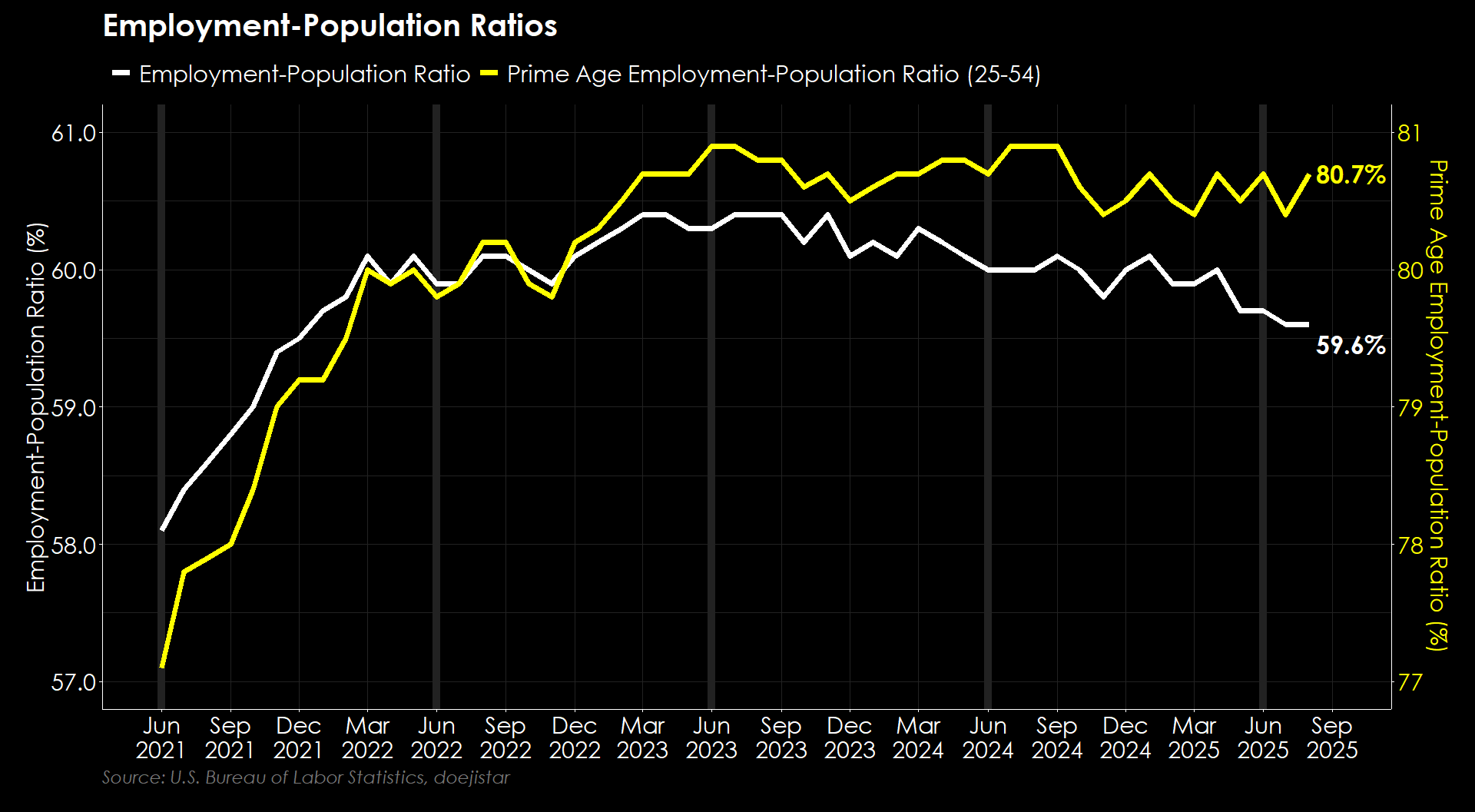

Another metric they will probably look at is the Employment to Population ratio which, suggests slack is not in the critical (at least for the short-term) areas of the economy; for instance when we look at the Prime Age Employment Ratio, it is holding up just fine.

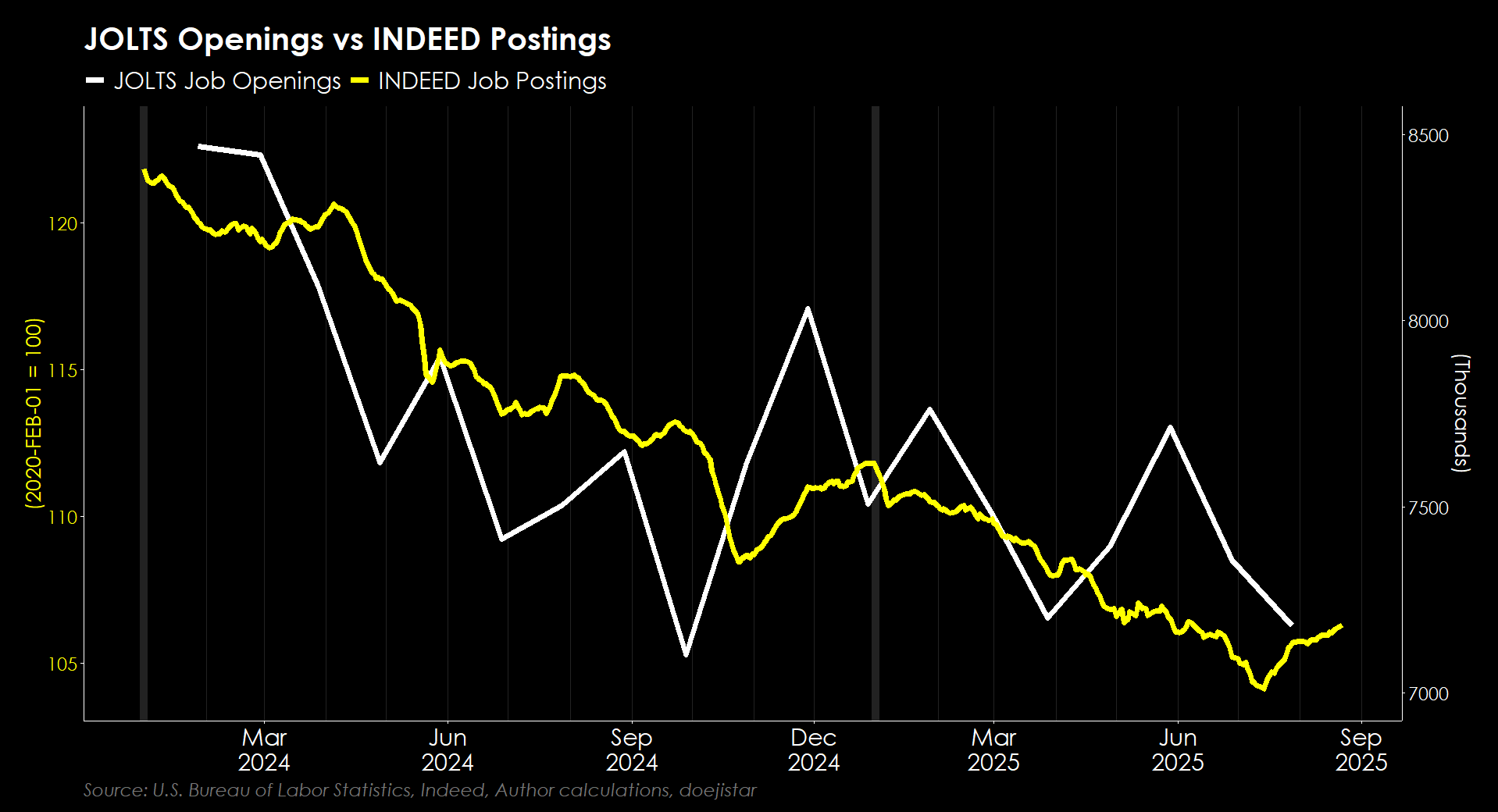

JOLTS, another BLS report that is showing a conflicting picture with other measures is also suggesting deeper demand weakness. The Indeed Job Postings index has seen a fairly strong rebound in July that has continued into August.

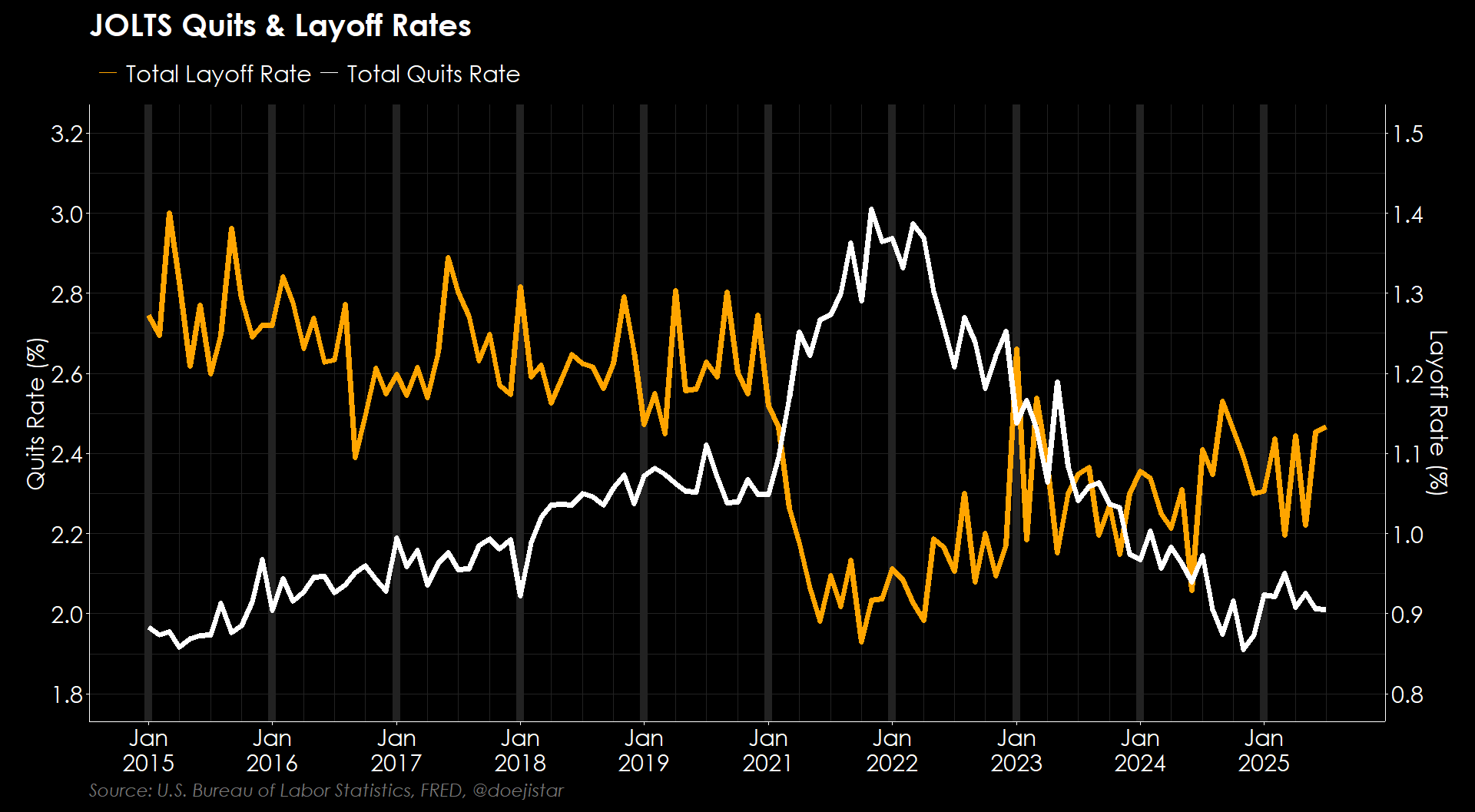

Layoffs are also rising, but it is still a historically low-levels and well below levels that has been synonymous with a healthy-ish economy.

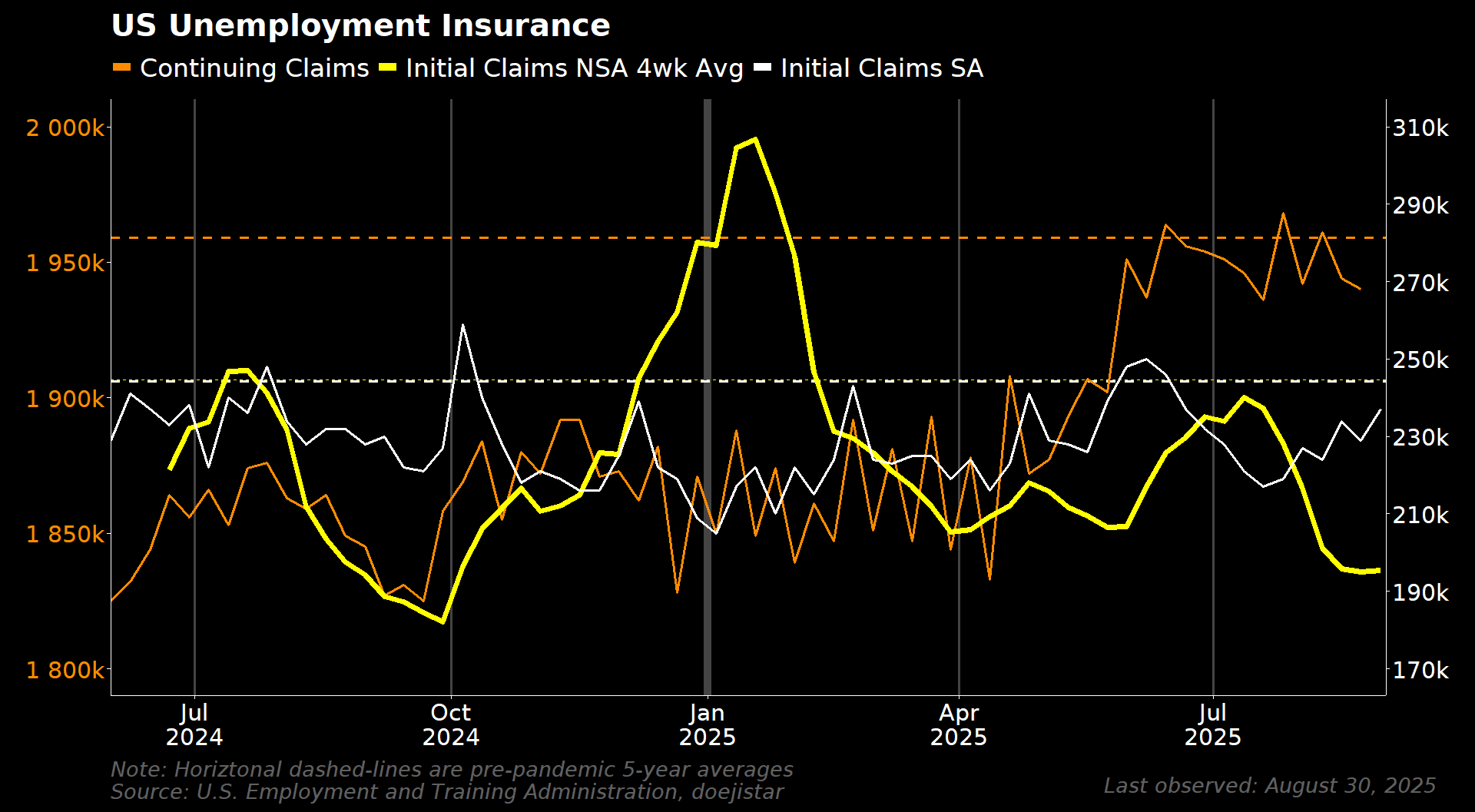

While the headline initial claims number did see another weekly rise, the trend in the unadjusted series (in Yellow) has been declining since July and has more recently remained stable hovering just above 190k for a 3rd straight week. Continuing claims also saw a 2nd consecutive weekly decline also.

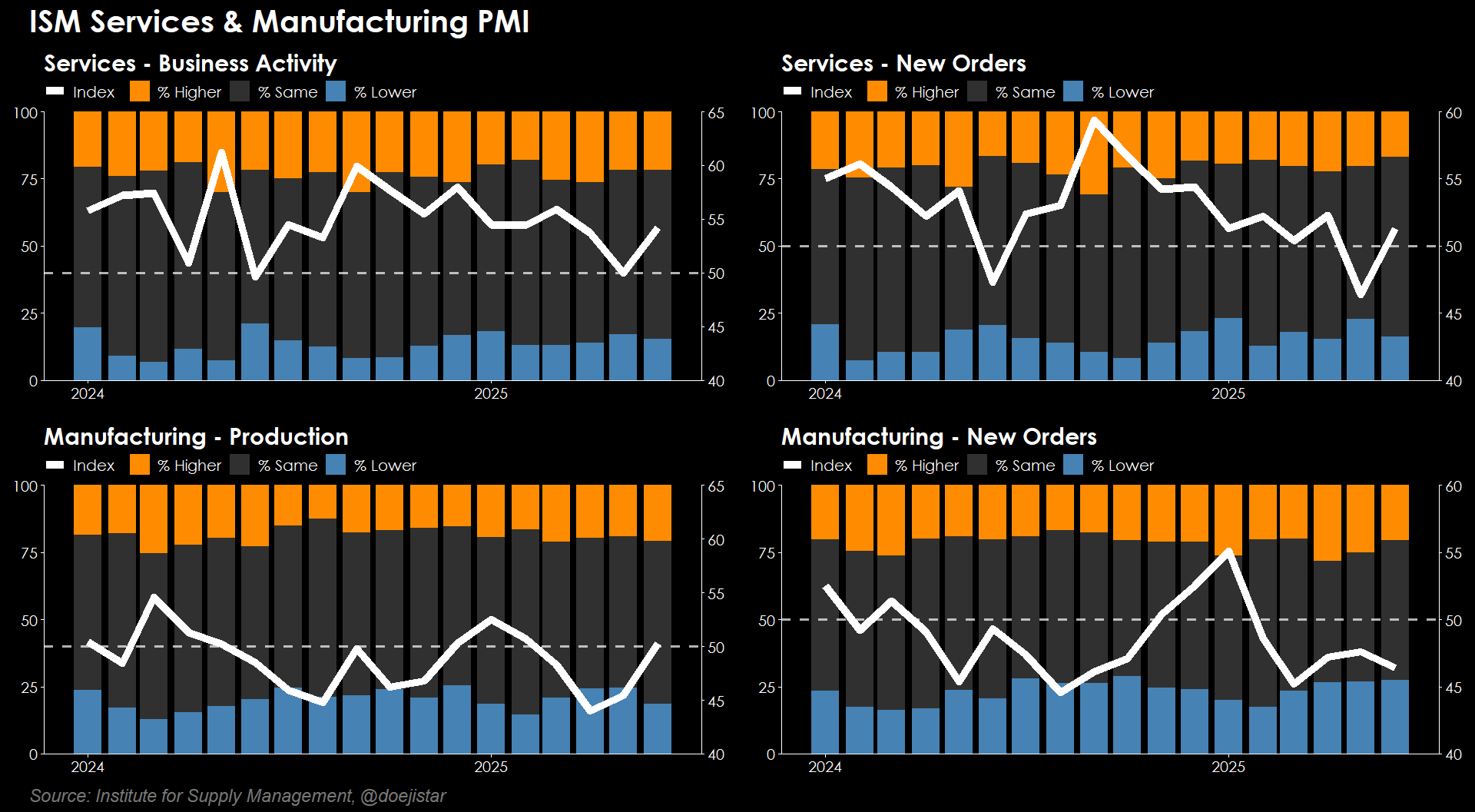

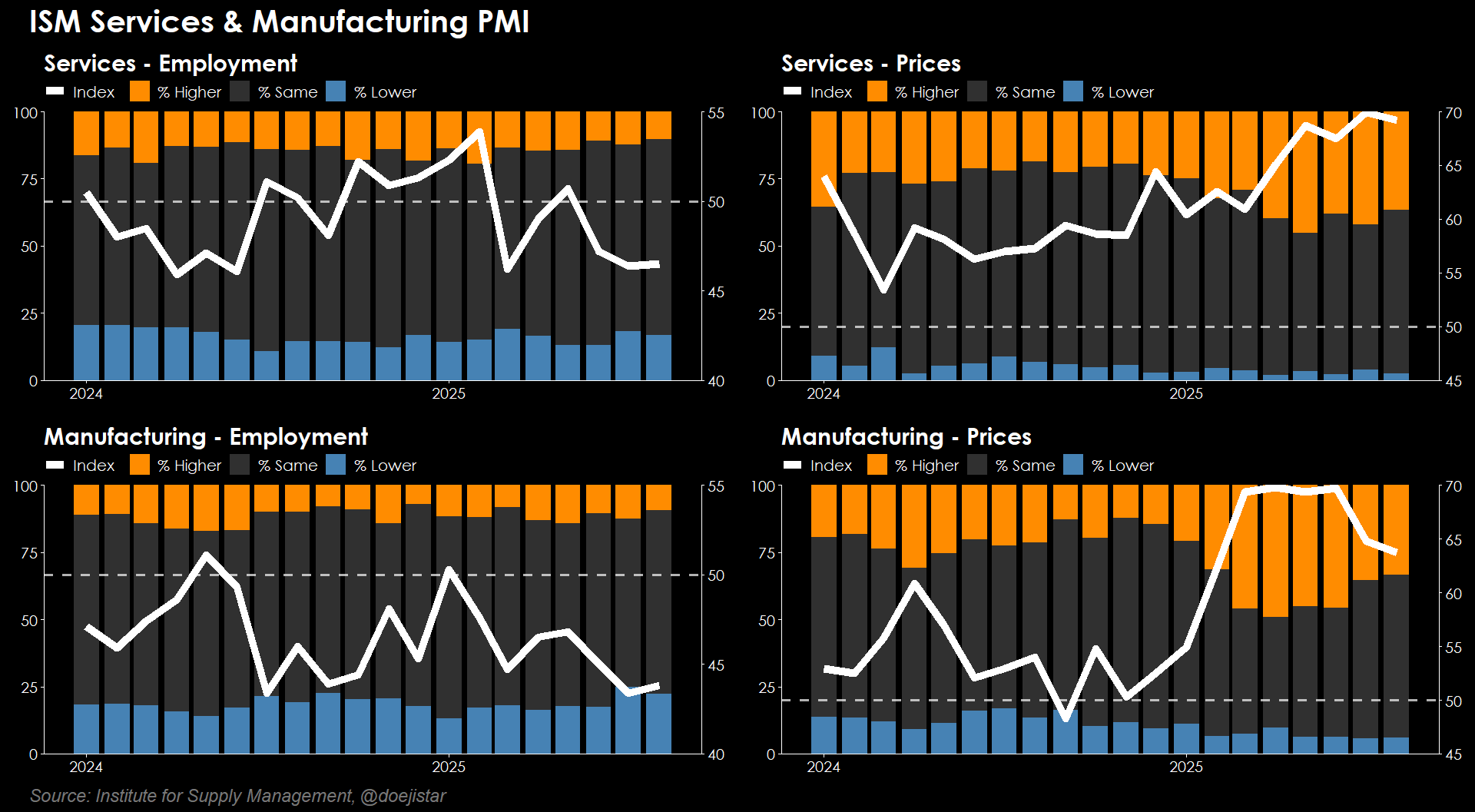

ISM PMI reports were generally quite positive. Manufacturing printed 48.7 which was higher than the previous month's 48.0 but a touch below the 49.0 expected; Services saw a healthy rebound to 52.0 from 50.1 the prior month and 1.9ppts above the 50.1 expected.

Business activity and Production was higher, New Orders for Services rebounded into expansion though it weakened for Manufacturing. Employment metrics remain concerning however though it ticked up very slightly last month.

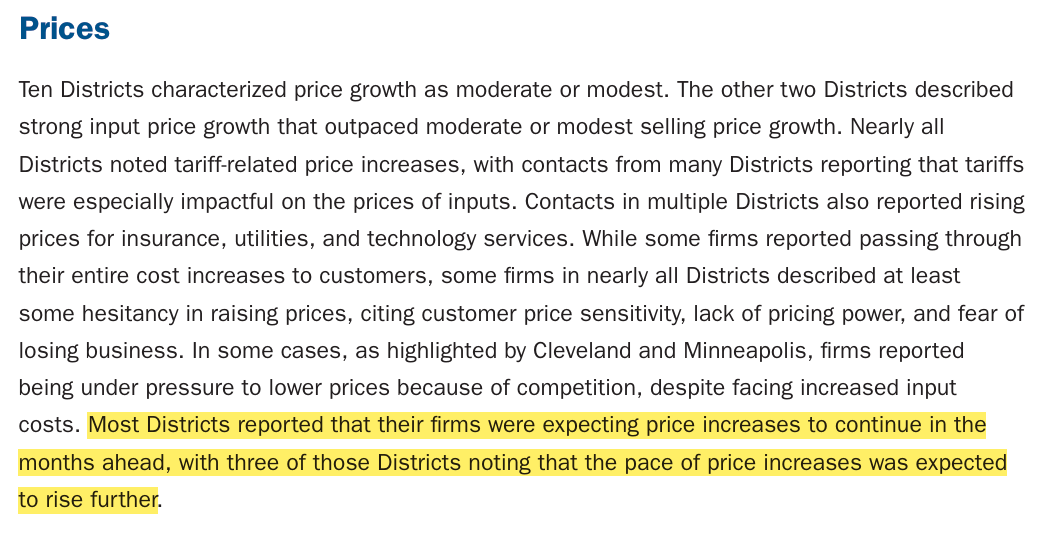

ISM Prices paid dropped off slightly last month but continues to be strong, and the recent Fed's Beige Book reports that most firms expect "price increases to continue in the months ahead", and some "noting that the pace of price increases was expected to rise further".

Putting it all together, 1) BLS data on the labour market doesn't appear to be as weak as it would suggest when looking at ADP, Indeed Job Postings and Claims data; and 2) business surveys show activity to be in decent shape while there are still some upside risks to prices.

Market has gone on to price in odds of a 50bps cut for the September meeting, but could the market be placing too much weight on the BLS data whose reliability is highly questionable? I certainly think so.

My base case was in fact for a no cut in September and leaning towards 1 cut for the remainder of this year. But given the market fully expects a September cut and, personally finding it difficult to argue against such overwhelming consensus, my base case has shifted to a hawkish cut just to avoid the market throwing a tantrum - "you wanted your rate cut, so here it is, but we are on watch for the next few meetings even though we continue to suggest every meeting is live". I don't agree with that move given my assessment of the data, but market expectations are so strong that I now see that as the most likely scenario.

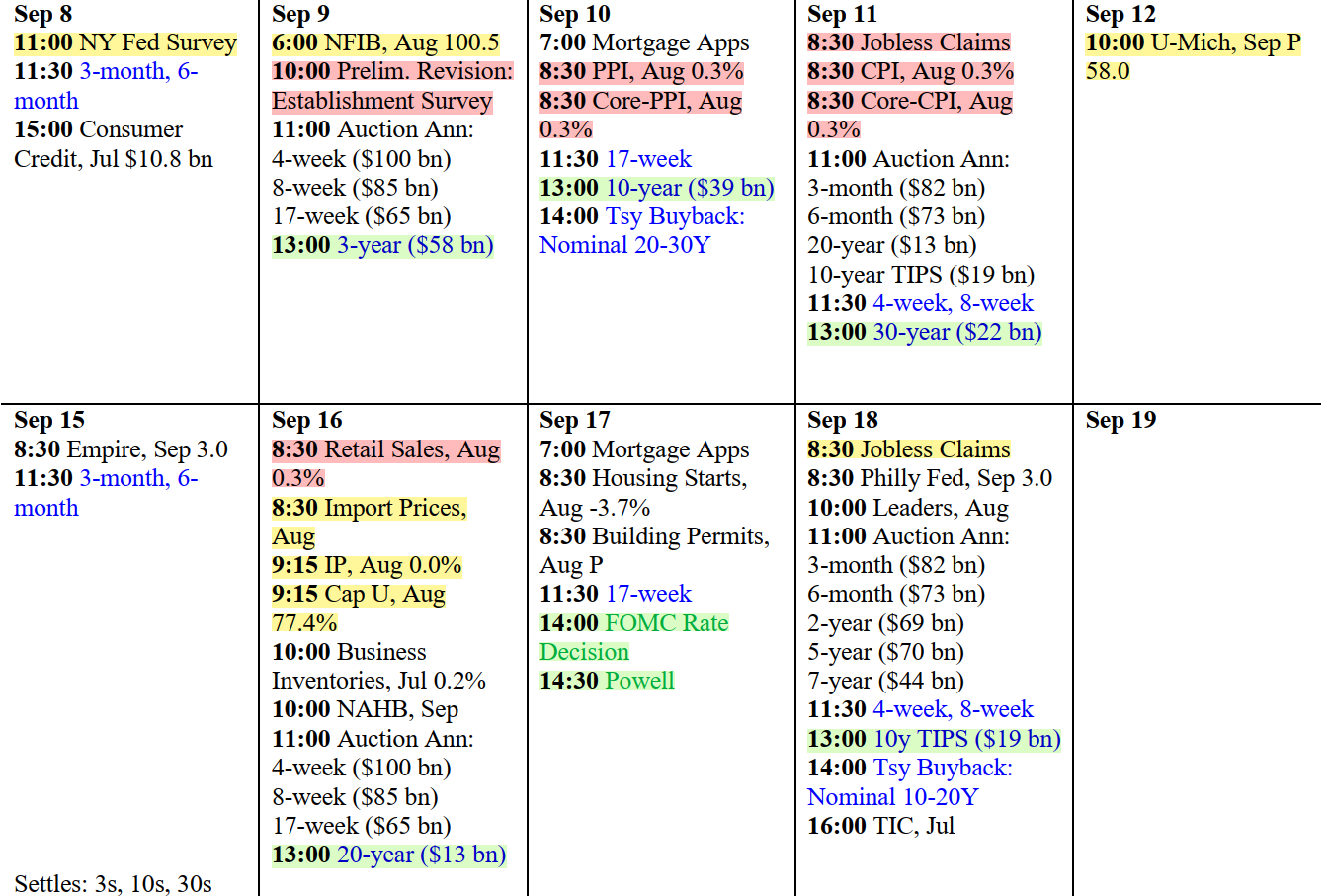

We still have a BLS NFP revision, PPI and CPI to get through this week which will likely have the last bearing on whether the Fed moves ahead with the 25bps cut as expected, and whether if it's a hawkish one should inflation come in hotter that expectations.